- U.S. stocks rose modestly on Thursday after the House approved the Republican tax bill in a narrow vote.

- President Trump hailed the bill as “one big beautiful tax bill” that now heads to the Senate for final approval.

- Bond markets saw sharp reversals as the 30-year yield dropped to 5.06% by midday after earlier spiking.

- Investors responded positively to easing yields and looked past mixed business activity data for May.

- The Congressional Budget Office projects the tax plan would add $3 trillion to the deficit over 10 years.

Markets Rebound on Legislative and Rate Signals

Wall Street regained some ground Thursday afternoon after enduring early-week losses, buoyed by a combination of legislative momentum and a pullback in Treasury yields. The U.S. House of Representatives narrowly passed President Donald Trump’s Republican-led tax reform bill, described by the president as “one big beautiful tax bill,” in a 215–214 vote. The measure now moves to the Senate, where a tougher battle is expected.

Investors took comfort in the fiscal progress despite growing concerns about its long-term impact. According to the Congressional Budget Office, the proposed legislation is projected to add approximately $3 trillion to the national deficit over the next decade.

Meanwhile, bond markets experienced a volatile session. The 30-year Treasury yield surged to 5.15% early in the day, but reversed course by midday, falling 9 basis points to 5.06%, as traders rotated back into long-duration bonds. Analysts pointed to the attractive yield environment and reduced inflationary expectations as drivers of renewed demand.

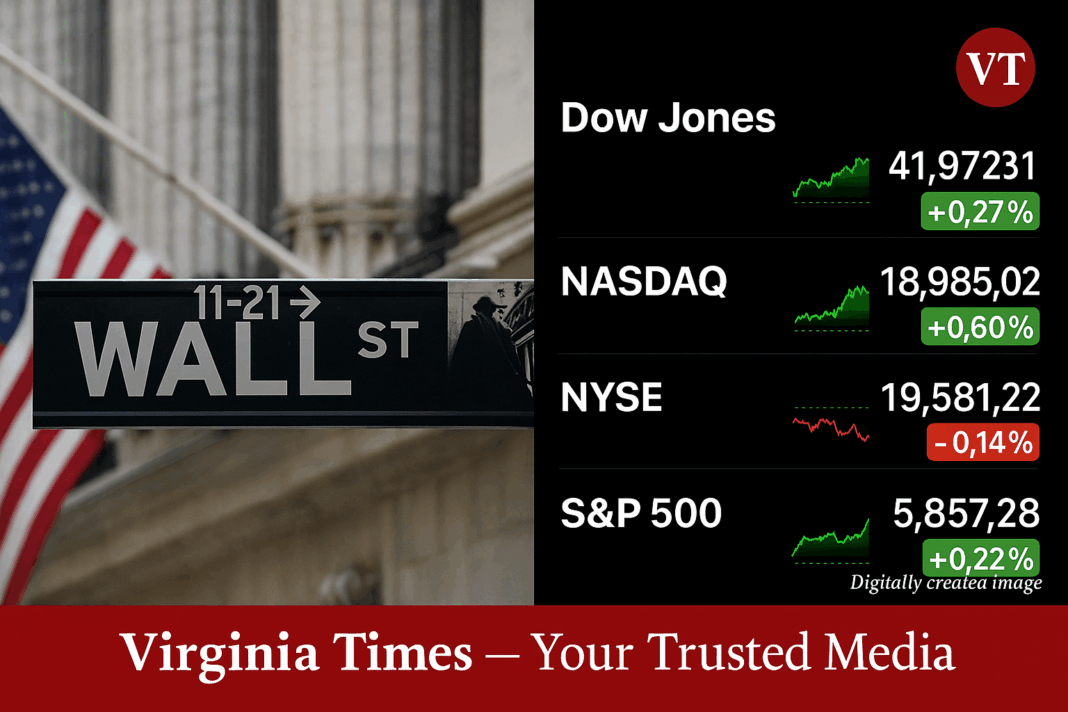

Index Recap as of 1:38 PM EST

| Major Index | Price | 1-Day % Change |

|---|---|---|

| Dow Jones | 41,972.31 | +0.27% |

| NASDAQ | 18,985.02 | +0.60% |

| NYSE | 19,581.22 | -0.14% |

| S&P 500 | 5,857.28 | +0.22% |

| Russell 2000 | 2,047.68 | +0.06% |

The Nasdaq Composite led the way higher, gaining 0.60%, while the Dow Jones Industrial Average and S&P 500 followed with moderate increases. The NYSE Composite lagged behind, dipping slightly, indicating some investor hesitancy in broader market sectors. The Russell 2000, often seen as a gauge of domestic economic sentiment, edged up modestly.

Bitcoin, meanwhile, briefly crossed $111,500 amid wider market optimism.

Outlook: Eyes on the Senate

With the House vote completed, attention now turns to the Senate’s response, where divisions among Republicans could complicate passage. Market participants will also watch incoming inflation data and remarks from Fed officials to gauge the trajectory of interest rates.

According to Reuters, investors are recalibrating their portfolios as they weigh the benefits of tax cuts against the risk of long-term fiscal strain.

For more trusted news, visit Virginia Times.

A global media for the latest news, entertainment, music fashion, and more.