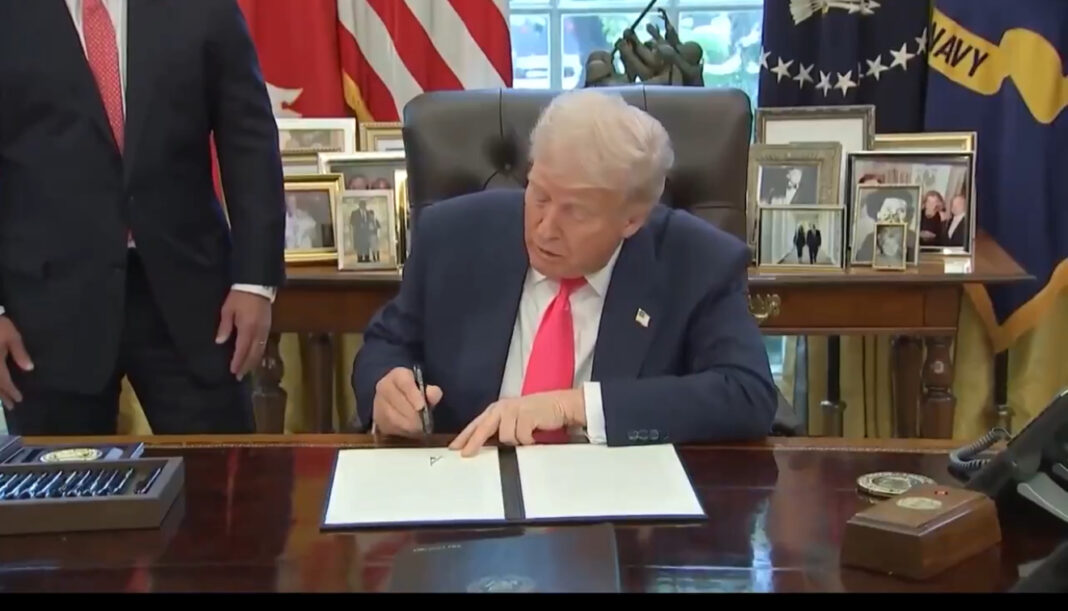

- President Donald Trump issued a proclamation on Aug. 14, 2025, honoring the 90th anniversary of the Social Security Act.

- The White House says the “vast majority” of seniors will pay zero tax on Social Security benefits following the recent One Big Beautiful Bill.

- The administration highlights anti-fraud efforts and shorter wait times at Social Security field offices.

The Big Picture

Marking the 90th anniversary of the Social Security Act, the President issued a presidential proclamation praising the program’s legacy and pledging continued support. The proclamation credits last month’s One Big Beautiful Bill with ensuring the “vast majority” of seniors will owe no federal tax on their Social Security benefits. Subsequent sections of the statement emphasize anti-fraud measures and a push for faster service at the Social Security Administration.

What’s New

The administration frames the new law as the largest tax relief for seniors in U.S. history and says it is targeting fraud, waste, and improper payments to protect the program’s finances. Officials also point to operational changes intended to reduce delays in field offices and speed up benefit delivery. The proclamation links these efforts to safeguarding Social Security and Medicare for those who paid into the system.

What They’re Saying

Context

President Franklin D. Roosevelt signed the Social Security Act on Aug. 14, 1935, establishing an insurance program for retirement and other benefits. Over time, Congress has adjusted eligibility, financing, and administrative rules. The current White House message pairs an anniversary commemoration with claims of major tax relief for seniors, tighter enforcement against improper payments, and operational improvements at the Social Security Administration.

What’s Next

Implementation details, IRS guidance, and administrative steps will determine how broadly seniors experience the promised “zero tax” outcome. Lawmakers and oversight bodies are likely to scrutinize fraud-prevention claims and service benchmarks at field offices as the changes roll out.

The Bottom Line

The proclamation celebrates Social Security’s 90th year while positioning the new law as sweeping tax relief for retirees and a renewal of anti-fraud and service goals. How the measures play out in practice will shape their impact on seniors and the program’s long-term finances.

A global media for the latest news, entertainment, music fashion, and more.