- The Fed held interest rates steady at 4.25% to 4.5% for the fourth consecutive meeting.

- Economic growth has “moderated” in the first half of 2025, according to the Fed.

- Labor markets remain strong, but inflation pressures persist above target.

- Two Fed governors dissented, voting to cut rates by 25 basis points.

- President Trump has publicly urged the Fed to lower rates to stimulate growth.

The Big Picture

The Federal Reserve opted to keep its benchmark interest rate unchanged on Wednesday, citing “moderating” economic growth and persistent inflation. In a statement issued after the conclusion of its July policy meeting, the Federal Open Market Committee (FOMC) reaffirmed its target range of 4.25% to 4.5%, maintaining its current stance amid ongoing uncertainty in the economic outlook.

“Recent indicators suggest that growth of economic activity moderated in the first half of the year,” the Fed said in its official statement. “The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.”

Why It Matters

While the Fed has paused its rate hikes since March, inflation has not yet returned to the central bank’s long-term 2% target. Consumer price data for June showed inflation cooling slightly but remaining above 3.1% annually. The FOMC reiterated that it “is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.”

Wednesday’s decision came amid heightened political pressure from President Donald Trump, who has publicly called on the Fed to cut interest rates more aggressively to support growth. Speaking last week in Michigan, Trump said, “We need rate cuts now—not in December. Our economy needs to move, and the Fed is holding it back.”

What They’re Saying

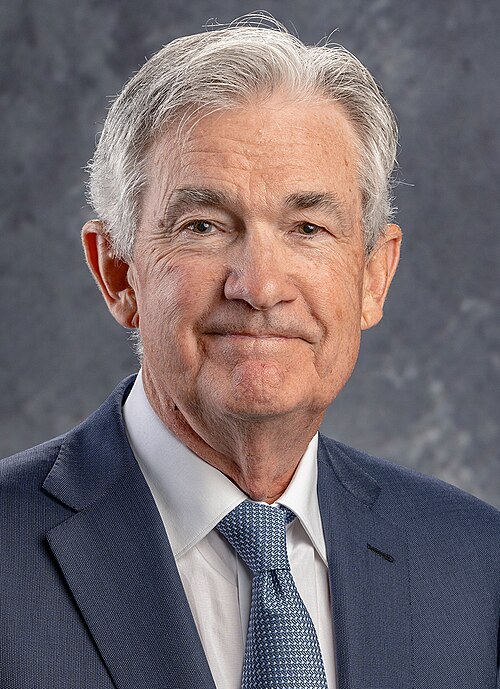

Fed Chair Jerome Powell, along with Vice Chair John C. Williams and six other voting members, supported the decision to hold rates. However, Michelle W. Bowman and Christopher J. Waller dissented, favoring a 25-basis-point cut.

Analysts say the Fed’s language indicates a careful balance between watching inflation trends and responding to broader political and global financial risks. “The Fed is clearly trying to maintain its independence while signaling it could act if conditions worsen,” said David Wessel, director of the Hutchins Center at Brookings.

Trump’s Ongoing Pressure on the Fed

President Trump has repeatedly criticized the Fed’s cautious approach, arguing that high interest rates are hindering industrial growth and middle-class recovery. On July 25, he posted on Truth Social: “Powell is stalling again. We need America First policies—including lower rates.”

Earlier this year, the White House reportedly explored legal options to expand presidential influence over monetary policy, although no formal action has been taken. The Federal Reserve remains an independent body, with decisions made solely by the FOMC.

What’s Next

The Fed said it will “carefully assess incoming data, the evolving outlook, and the balance of risks” when determining future changes to its benchmark rate. Market analysts expect a potential rate cut in the final quarter of 2025 if inflation data continues to ease and GDP growth softens further.

The Bottom Line

The Fed’s decision to hold steady reflects ongoing caution amid complex economic conditions. As political pressure mounts and inflation lingers, the central bank is navigating a delicate path between growth, price stability, and institutional independence.

Beijing Floods Kill 30, Xi Orders Emergency Evacuation

India Responds to Trump’s 25% Tariff Threat and Sanctions Talk

Follow Virginia Times for regular news updates. Stay informed with the latest headlines, breaking stories, and in-depth reporting from around the world.

A global media for the latest news, entertainment, music fashion, and more.