The Federal Open Market Committee (FOMC) on Friday unanimously approved updates to its Statement on Longer-Run Goals and Monetary Policy Strategy, the document that guides how the Fed pursues maximum employment and stable prices, according to a Federal Reserve press release. The Fed said the revisions incorporate lessons from the past five years to improve transparency, accountability, and effectiveness while maintaining the longer-run 2% inflation goal.

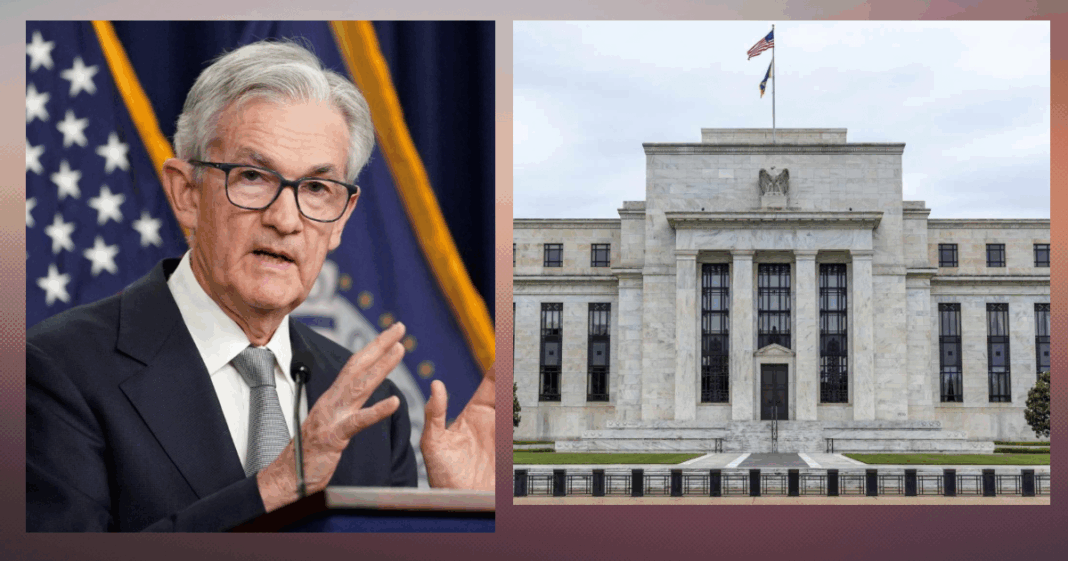

Chair Jerome Powell outlined the changes and the current economic backdrop in prepared remarks at Jackson Hole, noting that the labor market “remains near maximum employment,” inflation has fallen significantly from its highs, and near-term risks are shifting—upside for inflation and downside for employment—based on recent data and policy developments. His remarks accompanied the revised framework and can be read in full in the speech text released by the Fed.

The updated framework de-emphasizes the effective lower bound as a defining feature of the policy landscape and returns to flexible inflation targeting. It also clarifies that employment can run above real-time assessments of maximum employment without necessarily risking price stability, while preserving scope for pre-emptive action if inflation risks rise. When employment and inflation objectives are in tension, the Committee will follow a balanced approach, weighing the size of departures from its goals and the time horizons for returning to mandate-consistent levels. Subsequent references to these changes will be reflected in policy communications and meeting statements, according to the Fed.

A global media for the latest news, entertainment, music fashion, and more.